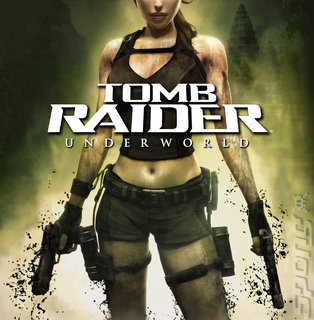

Eidos's key asset.

Japanese powerhouse publisher, Square Enix, has shown a clear interest in Eidos - potentially putting it in conflict with Warner Brothers in an acquisition war.

Square's president, Yoichi Wada, has visited Eidos's IO Studio - the Danish developer behind the Hitman series - and is reportedly set to head to the UK shortly to talk about an acquisition.

This comes from industry gaming bible, MCV, which says that it also understands Warner Brothers to be interested in purchasing Eidos.

Square has made a lot of noise about becoming more global in its outlook recently. Recently the publisher announced a 'strategic partnership' with US developer Gas Powered Games which will see it publish Supreme Commander 2.

Warner Brothers, meanwhile, already owns a 16% share in Eidos. The US company and Eidos recently got a little cosier when it was agreed that a "standstill" arrangement would be ended, enabling Warners to own a stake of up to 30% in the company prior to the previous arrangement's end.

With its existing stake, Warners would have to spend around $30 million (£20.6 million) to get a majority share in Eidos and $80 million (£54.8 million) for total control. Given the two companies' existing relationship and Warner's interest in expanding its presence in the games industry, the two companies would make natural bedfellows.

That said, Square could gain a lot from a purchase. While it has had Western success with the Final Fantasy series, its publishing line-up is still very Japan-centric. Gaining properties such as Tomb Raider and Hitman would give it a strong footing in the Western market. Alternatively, Square could just be interested in picking at Eidos, acquiring particular assets such as IO Studio.

Elsewhere, it has been rumoured that Electronic Arts and Ubisoft are both interested in Eidos.

This comes hot on the heels that Eidos publishing's holding company, SCi, is seeking to change its name to Eidos.

Eidos, for its part, has had a tumultuous year. It's seen massive international re-structuring, management shake-ups and rocky finances (including plummeting share prices and quadrupled losses).

Source: MCV

Square's president, Yoichi Wada, has visited Eidos's IO Studio - the Danish developer behind the Hitman series - and is reportedly set to head to the UK shortly to talk about an acquisition.

This comes from industry gaming bible, MCV, which says that it also understands Warner Brothers to be interested in purchasing Eidos.

Square has made a lot of noise about becoming more global in its outlook recently. Recently the publisher announced a 'strategic partnership' with US developer Gas Powered Games which will see it publish Supreme Commander 2.

Warner Brothers, meanwhile, already owns a 16% share in Eidos. The US company and Eidos recently got a little cosier when it was agreed that a "standstill" arrangement would be ended, enabling Warners to own a stake of up to 30% in the company prior to the previous arrangement's end.

With its existing stake, Warners would have to spend around $30 million (£20.6 million) to get a majority share in Eidos and $80 million (£54.8 million) for total control. Given the two companies' existing relationship and Warner's interest in expanding its presence in the games industry, the two companies would make natural bedfellows.

That said, Square could gain a lot from a purchase. While it has had Western success with the Final Fantasy series, its publishing line-up is still very Japan-centric. Gaining properties such as Tomb Raider and Hitman would give it a strong footing in the Western market. Alternatively, Square could just be interested in picking at Eidos, acquiring particular assets such as IO Studio.

Elsewhere, it has been rumoured that Electronic Arts and Ubisoft are both interested in Eidos.

This comes hot on the heels that Eidos publishing's holding company, SCi, is seeking to change its name to Eidos.

Eidos, for its part, has had a tumultuous year. It's seen massive international re-structuring, management shake-ups and rocky finances (including plummeting share prices and quadrupled losses).

Source: MCV

Read More Like This