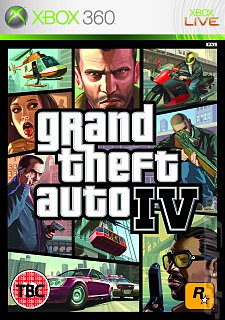

Official GTA IV Maker Ready to Take Bids

Projected sales of six million in first week

Pre-orders for GTA IV projected at six million copies globally - with expectations of nine million copies sold before the year is out.

Publisher Take-Two's CEO, Ben Feder, thinks that these predictions are too low however, telling Reuters, "Our expectations are very high, higher than analysts give the game credit for. All the analysts had a (sales) number, give or take, and I think we will be on the upside of that rather than the downside."

So, what does all this mean for the company? Well, today is also the official deadline for Take-Two to 'initiate discussions' with Electronic Arts as well as other potential bidders. Back on February 25th T2's executive chairman, Strauss Zelnick, stated that:

Publisher Take-Two's CEO, Ben Feder, thinks that these predictions are too low however, telling Reuters, "Our expectations are very high, higher than analysts give the game credit for. All the analysts had a (sales) number, give or take, and I think we will be on the upside of that rather than the downside."

So, what does all this mean for the company? Well, today is also the official deadline for Take-Two to 'initiate discussions' with Electronic Arts as well as other potential bidders. Back on February 25th T2's executive chairman, Strauss Zelnick, stated that:

"...given the great importance of the Grand Theft Auto IV launch to the value of Take-Two, the board has determined that the only prudent and responsible course for our company and its stockholders is to defer these discussions until immediately after Grand Theft Auto IV is released.

"Therefore, we offered to initiate discussions with EA on April 30th, 2008 (the day after Grand Theft Auto IV is scheduled to release)."

Take-Two's NASDAQ share price closed at $26.63 (£13.20) yesterday, above Electronic Arts' proposed offer of $25.74 (£12.50). EA had dropped its price per share offer from $26 (£13) in order to maintain its $2billion offer. EA's share price closed down by 15 cents (7p) at $51.68 ($25.75).

The only other video game company likely to be in a position to offer to purchase Take-Two at this high-water mark in the company's history would be the newly formed Activision/Vivendi publisher, Activision Blizzard, which is valued at $9.85 billion (£4.9b) compared to EA's current $16.3b (£8b) valuation. As of now, however, nothing official has been heard from that camp.

"Therefore, we offered to initiate discussions with EA on April 30th, 2008 (the day after Grand Theft Auto IV is scheduled to release)."

Take-Two's NASDAQ share price closed at $26.63 (£13.20) yesterday, above Electronic Arts' proposed offer of $25.74 (£12.50). EA had dropped its price per share offer from $26 (£13) in order to maintain its $2billion offer. EA's share price closed down by 15 cents (7p) at $51.68 ($25.75).

The only other video game company likely to be in a position to offer to purchase Take-Two at this high-water mark in the company's history would be the newly formed Activision/Vivendi publisher, Activision Blizzard, which is valued at $9.85 billion (£4.9b) compared to EA's current $16.3b (£8b) valuation. As of now, however, nothing official has been heard from that camp.

Companies:

Take 2

Read More Like This

Comments

You know I think the reason why Microsoft is not putting in a bid is probably not to upset certain agreements Microsoft and EA have with exclusives such as Mass Effect...Personally I would rather Microsoft take over and let Mass Effect go onto other consoles as GTA would be a huge system seller.

If EA take over I dont think I will be buying GTA ever again...

If EA take over I dont think I will be buying GTA ever again...

No, you're wrong.

The reason they aren't bidding is because it doesn't make financial sense. GTA is a multiplatform game, MS would in essence be buying Take-Two at a loss, as its worth less (not worthless) to them as it would be to an EA.

I'm not very familliar with the buisness/economics of the industry or specific situation, but I would hope that there is a path forward which would allow Take-Two to remain independent, or at least maintain a large degree of soveregnty.

The reason they aren't bidding is because it doesn't make financial sense. GTA is a multiplatform game, MS would in essence be buying Take-Two at a loss, as its worth less (not worthless) to them as it would be to an EA.

I'm not very familliar with the buisness/economics of the industry or specific situation, but I would hope that there is a path forward which would allow Take-Two to remain independent, or at least maintain a large degree of soveregnty.

more comments below our sponsor's message

Well EA took bioware - Mass Effect PC and 360.

If Microsoft was to buy Take Two GTA alone would ensure the success of the Xbox overall if you get what I mean.

Overall either Take Two stay alone or if EA take over well I just hope EA don't have any input to how the game is created...

If Microsoft was to buy Take Two GTA alone would ensure the success of the Xbox overall if you get what I mean.

Overall either Take Two stay alone or if EA take over well I just hope EA don't have any input to how the game is created...

PreciousRoi wrote:

The reason they aren't bidding is because it doesn't make financial sense. GTA is a multiplatform game, MS would in essence be buying Take-Two at a loss, as its worth less (not worthless) to them as it would be to an EA.

Microsoft won't buy Take 2 because they don't want to be the owners of Manhunt. Hardware manufacturers already catch enough crap from the "establishment" because it's not properly understood that they don't publish every game that appears on their platforms.

Good point, that was also in the back of my head, not for Manhunt alone, but the GTA series as well.

As always, I bow to your superior objective knowlege of the industry.

As always, I bow to your superior objective knowlege of the industry.

tyrion wrote:

PreciousRoi wrote:

The reason they aren't bidding is because it doesn't make financial sense. GTA is a multiplatform game, MS would in essence be buying Take-Two at a loss, as its worth less (not worthless) to them as it would be to an EA.

Microsoft won't buy Take 2 because they don't want to be the owners of Manhunt. Hardware manufacturers already catch enough crap from the "establishment" because it's not properly understood that they don't publish every game that appears on their platforms.

it is a good pint but i cant see the manhunt series continuing though why couldnt they just drop it from the portfolio?