At the end of this week we at UKIE are due to receive a report commissioned from legal experts Osborne Clarke on the legal landscape here in the UK specifically with respect to crowd funding.

This is not a new idea, but last week saw it come smack bang into the gaming consciousness when Tim Schafer and Ron Gilbert and their company Double Fine announced that they were going to crowd fund, via Kickstarter, their new project. It broke all records and got a massive amount of exposure all through Twitter.

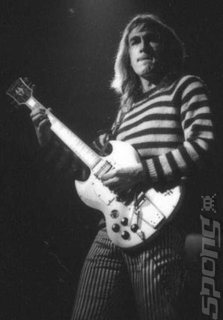

This took me back to a crowd-sourced project I ran back in 2002 when some friends and fans of John Otway managed to get this little known, but immensely loved rock star, his first top ten record (Bunsen Burner) which charted at number 7 in October 2002.

National Newspaper

We did this for Otway for his 50th birthday, precisely 25 years after his only hit - Cor’ Baby That’s Really Free) - which charted at the front end of the Punk explosion in December 1977. We let the fans decide what songs Otway would sing live and then gave the audience at a packed Astoria in London the ultimate and deciding vote. They voted for Bunsen Burner. They owned that hit. We all called it The Hit.

Once they had chosen Bunsen Burner, we booked the London Palladium to celebrate The Hit before we released the record and mobilised all the fans. It was an amazing project to work on as well as being immense fun, and crucially WE had beaten the system. Otway had long since been dropped by his record label, but had worked hard on the Indie music scene and had built his fanbase. We got massive PR coverage, being featured on BBC, Channel 4 and ITV. We made the national newspapers and even got invited on to Top of the Pops. Amazing!

My mind then goes back about two and a half years to when I was sitting in my small London office with a good friend of mine, Harry Miller who along with his friend Mike Wilson set up Gathering of Developers.

We were discussing the principle of crowd funding (we called it “crowd sourcing” at that time). We mused about selling loads of shares to loads of people in a start-up games publisher that we would set up to help indie developers get their games into gamers' hands in the new digital world.

I did some work checking out how the US and UK law stood on all of this and it was clear that offering equity, or a slice of the action, in any company would be tough.

Ungeared Law

The law on both sides of the Atlantic wasn’t really geared for up for this sort of venture it seemed. We thought it would be a great way to offer fans of a particular genre or dev team - or indeed fans who were interested in new stuff - a piece of the action and would be a great way of involving gamers from the start.

We agreed it couldn’t be that hard to do, after all I had an e-commerce business (The Producers) and, with Just Flight and Just Trains, we had been making and selling games and software by digital download for five years running up to that time.

We had all the billing, subscription and database software in place. We also had valuable experience of dealing with thousands of customers directly, something that other game makers, whether developers or publishers, had tended to shy away from. But we decided that the law was too restrictive and we would have to revert to the usual forms of investment.

Fast forward to October 2011. My colleagues at The Association for UK Interactive Entertainment (UKIE) and I were discussing the perennial problem of game makers getting access to affordable and accessible funding in order to make original games.

With access to millions of gamers via digital markets opening up further all the time, we wanted to work out how we could open the financial arteries to supply the much needed capital.

For years we had been frustrated by successive Governments who had just not delivered with production tax credits - or tax breaks, as they have become known - and even when they were granted in February 2010, they were snatched back by the new Government on 22nd June 2010.

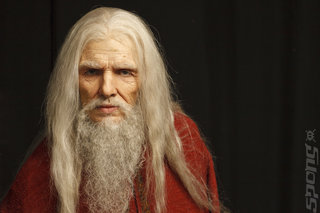

Merlin's Bad Spell

If you are a young or an old game maker you have as much chance to get a bank to lend you money as a 92 year-old would be able to get a life assurance policy. Banks rarely understand what we do, let alone actually do anything about it. That form of lending is called ‘Debt Lending'. Think of it a bit like a credit card debt – it has to be paid back and it carries interest payments.

The UK Government determined to get banks to lend to small businesses and named this scheme Project Merlin, which is rather aptly named, you need Merlin’s magic wand nowadays to get any debt finance. (Editor's note: in the few hours between Andy sending us his feature and it going live, the Bank of England confirmed that Project Merlin's lending target had been missed... by £1.1 Billion.)

Venture capitalists are a hard-nosed breed and they go for an Equity Lending approach. They take big risks by definition and invest money in return for a slice of the pie. They aim to get a high exit price; they sell your business or the part of the business they own, usually within a couple of years of buying in.

They work the numbers game, typically making many bets and hoping that 1-in-5 come up trumps - and they can return typically 40% on their capital on the winning one out of five winning bet.

“Angel” investors are another equity investment source and get closer to a crowd funding model, all be it a small crowd of people who generally know each other. These people are usually high net worth individuals who have spare money to invest.

Bankers' Bonus Bonus

Schemes like the Enterprise Investment Scheme (EIS) will allow investors in a company (not a project) to offset 30% of the cost of the shares against their tax liability. It is there to encourage those with excess money, usually received via a bonus (let’s say a banker) who would pay 40 -50% of that bonus in income tax, to offset 30% of that if they invest in a company which may or may not pay off. It is more complex than that, but you get the idea.

We had been advised by the Department of Culture, Media and Sport (DCMS) that we needed to make our pre-Budget submission by the end of January 2012, which was quite normal. Indeed, UKIE does this each and every year. We wanted to continue to press hard for production tax credits of course, but we also decided we needed to put the power into the hands of all of our members and for them to entrust their customers: the gamers.

Times like these demand innovation and radical thought. We knew crowd funding could work and was working in other creative industries, for other creators, enabling them to bring their work to life. We just needed to get a full and informed legal opinion on exactly whether the UK law was geared to allowing a 21st century funding scheme built on scalable technology to work.

Legal and Decent

We do know that currently crowd funding in principle is completely legal under UK law, it is only a question of what one can give any funder in return for their money and indeed how much money they can invest.

We believe that there needs to be bold and decisive action, but we also need to ensure that there are sufficient safeguards built in to protect the funders. That is why UKIE have decided to stop talking and take a leading role in this exciting project. Our job will be to make the case for change to our Government and then facilitate the technology platform which will marry investors with game makers.

In the US the Entrepreneur Access to Capital Act was passed by the House of Representatives in November 2011 and this reduces restrictions on small-scale crowd funding of for-profit businesses currently present in state and securities law.

As usual the Americans are setting the pace, but it is not too late for the UK to get a piece of the action and empower smaller indie creators to link up with their fans, present and future. We await that report at the end of this week, and our suggestions will go straight to Her Majesty’s Government. There is literally no time to lose.

This is not a new idea, but last week saw it come smack bang into the gaming consciousness when Tim Schafer and Ron Gilbert and their company Double Fine announced that they were going to crowd fund, via Kickstarter, their new project. It broke all records and got a massive amount of exposure all through Twitter.

This took me back to a crowd-sourced project I ran back in 2002 when some friends and fans of John Otway managed to get this little known, but immensely loved rock star, his first top ten record (Bunsen Burner) which charted at number 7 in October 2002.

National Newspaper

We did this for Otway for his 50th birthday, precisely 25 years after his only hit - Cor’ Baby That’s Really Free) - which charted at the front end of the Punk explosion in December 1977. We let the fans decide what songs Otway would sing live and then gave the audience at a packed Astoria in London the ultimate and deciding vote. They voted for Bunsen Burner. They owned that hit. We all called it The Hit.

Once they had chosen Bunsen Burner, we booked the London Palladium to celebrate The Hit before we released the record and mobilised all the fans. It was an amazing project to work on as well as being immense fun, and crucially WE had beaten the system. Otway had long since been dropped by his record label, but had worked hard on the Indie music scene and had built his fanbase. We got massive PR coverage, being featured on BBC, Channel 4 and ITV. We made the national newspapers and even got invited on to Top of the Pops. Amazing!

My mind then goes back about two and a half years to when I was sitting in my small London office with a good friend of mine, Harry Miller who along with his friend Mike Wilson set up Gathering of Developers.

We were discussing the principle of crowd funding (we called it “crowd sourcing” at that time). We mused about selling loads of shares to loads of people in a start-up games publisher that we would set up to help indie developers get their games into gamers' hands in the new digital world.

I did some work checking out how the US and UK law stood on all of this and it was clear that offering equity, or a slice of the action, in any company would be tough.

Ungeared Law

The law on both sides of the Atlantic wasn’t really geared for up for this sort of venture it seemed. We thought it would be a great way to offer fans of a particular genre or dev team - or indeed fans who were interested in new stuff - a piece of the action and would be a great way of involving gamers from the start.

We agreed it couldn’t be that hard to do, after all I had an e-commerce business (The Producers) and, with Just Flight and Just Trains, we had been making and selling games and software by digital download for five years running up to that time.

We had all the billing, subscription and database software in place. We also had valuable experience of dealing with thousands of customers directly, something that other game makers, whether developers or publishers, had tended to shy away from. But we decided that the law was too restrictive and we would have to revert to the usual forms of investment.

Fast forward to October 2011. My colleagues at The Association for UK Interactive Entertainment (UKIE) and I were discussing the perennial problem of game makers getting access to affordable and accessible funding in order to make original games.

With access to millions of gamers via digital markets opening up further all the time, we wanted to work out how we could open the financial arteries to supply the much needed capital.

For years we had been frustrated by successive Governments who had just not delivered with production tax credits - or tax breaks, as they have become known - and even when they were granted in February 2010, they were snatched back by the new Government on 22nd June 2010.

Merlin's Bad Spell

If you are a young or an old game maker you have as much chance to get a bank to lend you money as a 92 year-old would be able to get a life assurance policy. Banks rarely understand what we do, let alone actually do anything about it. That form of lending is called ‘Debt Lending'. Think of it a bit like a credit card debt – it has to be paid back and it carries interest payments.

The UK Government determined to get banks to lend to small businesses and named this scheme Project Merlin, which is rather aptly named, you need Merlin’s magic wand nowadays to get any debt finance. (Editor's note: in the few hours between Andy sending us his feature and it going live, the Bank of England confirmed that Project Merlin's lending target had been missed... by £1.1 Billion.)

Venture capitalists are a hard-nosed breed and they go for an Equity Lending approach. They take big risks by definition and invest money in return for a slice of the pie. They aim to get a high exit price; they sell your business or the part of the business they own, usually within a couple of years of buying in.

They work the numbers game, typically making many bets and hoping that 1-in-5 come up trumps - and they can return typically 40% on their capital on the winning one out of five winning bet.

“Angel” investors are another equity investment source and get closer to a crowd funding model, all be it a small crowd of people who generally know each other. These people are usually high net worth individuals who have spare money to invest.

Bankers' Bonus Bonus

Schemes like the Enterprise Investment Scheme (EIS) will allow investors in a company (not a project) to offset 30% of the cost of the shares against their tax liability. It is there to encourage those with excess money, usually received via a bonus (let’s say a banker) who would pay 40 -50% of that bonus in income tax, to offset 30% of that if they invest in a company which may or may not pay off. It is more complex than that, but you get the idea.

We had been advised by the Department of Culture, Media and Sport (DCMS) that we needed to make our pre-Budget submission by the end of January 2012, which was quite normal. Indeed, UKIE does this each and every year. We wanted to continue to press hard for production tax credits of course, but we also decided we needed to put the power into the hands of all of our members and for them to entrust their customers: the gamers.

Times like these demand innovation and radical thought. We knew crowd funding could work and was working in other creative industries, for other creators, enabling them to bring their work to life. We just needed to get a full and informed legal opinion on exactly whether the UK law was geared to allowing a 21st century funding scheme built on scalable technology to work.

Legal and Decent

We do know that currently crowd funding in principle is completely legal under UK law, it is only a question of what one can give any funder in return for their money and indeed how much money they can invest.

We believe that there needs to be bold and decisive action, but we also need to ensure that there are sufficient safeguards built in to protect the funders. That is why UKIE have decided to stop talking and take a leading role in this exciting project. Our job will be to make the case for change to our Government and then facilitate the technology platform which will marry investors with game makers.

In the US the Entrepreneur Access to Capital Act was passed by the House of Representatives in November 2011 and this reduces restrictions on small-scale crowd funding of for-profit businesses currently present in state and securities law.

As usual the Americans are setting the pace, but it is not too late for the UK to get a piece of the action and empower smaller indie creators to link up with their fans, present and future. We await that report at the end of this week, and our suggestions will go straight to Her Majesty’s Government. There is literally no time to lose.

Read More Like This

Comments

The clanhelge and to a lesser extent, the complexity, is definitely saying adios to gaming, and I for one miss it. I'm the type of gamer who would play Dynasty Warriors 3 on the hardest difficulty setting and have to fight battles over and over again until I beat them, and loved every second of it.Newer gamers really don't know what challenging gaming is. They think because they play a modern game that requires 10 buttons to control that they're talented gamers, but stick Contra 3 in front of them like I did to my nephew, and they literally don't know what hit them.Sadly, I think casual gamers are here to stay, so I don't expect most developers to be back on our side anytime soon. They don't care if a casual gamer plays their game for a week and then ditches it, they got what they wanted, his/her money.